26+ Current va refinance rates

The average APR for a 30-year fixed refinance loan increased to 632 from 620 yesterday. Todays national mortgage rate trends.

2

Compare current mortgage rates.

. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Revising payment rates for durable medical equipment under the Medicare program through duration of emergency period. Todays Mortgage Refinance Rates. Second mortgages come in two main forms home equity loans and home equity lines of credit.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Your actual rate payment and costs could be higher. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

VA and USDA loans allow zero down. Always compare closing costs and refinance rates from multiple lenders. If you currently serve in the military or are a veteran youre potentially eligible for a VA loan.

So a refinance appraisal determines the current market value. To be eligible you must have satisfactory credit sufficient income to meet the expected. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Current mortgage refinance rates. This time last week the 30-year fixed APR was 619. Its not surprising that mortgage rates are climbing Danielle Hale chief.

Make sure the property meets all second home requirements to avoid paying higher interest rates now and on a refinance. Historical mortgage rates chart. It allows you to qualify for a low-cost mortgage when youre looking to purchase or refinance even if your credit isnt perfect.

Average for 2022 as of August 26 2022. As rates are expected to keep rising refinance is expected to make up a smaller share of the overall market. However those who do have a VA loan already may wish to consider a VA streamline refinance or interest rate reduction refinance loan IRRRL which can help you lower your interest rate or extend your repayment termA VA streamline refinance loan a simplified lending.

Refinance--A loan made under subsection b2 during the period beginning on January 31 2020 and ending on the date on which covered loans are. The average interest rate for a 30-year mortgage has broken 6 for the first time since 2008 at 602 last week. 10 20 30 etc.

Refinance rates change all the time driven by factors like the economy Treasury bond rates and demand. Money market rates are typically higher than traditional savings accounts. Lenders nationwide provide weekday mortgage rates to our.

A VA cash-out refinance is the only option for those who dont already have a VA loan. Purchase Loans and Cash-Out Refinance. While mortgage refinance rates typically have the same rates as purchasing.

The amount of new loans to refinance a home was expected to drop to 430 billion down 283 percent from 2017 while the amount of new mortgages to buy a home will likely increase by 73 percent to 12 trillion MBA said. The need to refinance your current mortgage. We requested data from 16 lenders that dominate the student loan refinance market and scored them across 15 data points in the categories of interest rates fees loan terms hardship options.

Rates shown are based on loan assumptions provided by you. Current mortgage rate market. VA rates disability from 0 to 100 in 10 increments eg.

30 year fixed FHA. 30 year fixed FHA. Chart represents weekly averages for a 30-year fixed-rate mortgage.

Lenders Handbook - VA Pamphlet 26-7 VA Home Loans VA Home Loans Certificate of Eligibility CoE Applying for Benefits. Increasing access to post-acute care during emergency period. GI Bill Payment Rates.

Benefit Rates Access Current Rates. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

No need for Private Mortgage. See the Combined Ratings section below for information about how VA calculates disability percentage for multiple disabilities. But remember rates for cash-out refinances tend to be 0125 to 025 higher than rates rate.

A VA loan is a top benefit of military service for eligible veterans service members and qualifying surviving spouses. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more.

Are current rates high or low when you read this. Mortgage loan basics Basic concepts and legal regulation. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

January 26 2015 How to. Competitively low interest rates. Second mortgage types Lump sum.

You can find out here. Stay up to date on current mortgage and refinance rates and see how interest rates are trending. However FHA VA and USDA loans have Streamline Refinance.

VA-guaranteed loans are available for homes for your occupancy or a spouse andor dependent for active duty service members. Compare money market accounts and open one today.

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Scholarships Student Financial Services Liberty University

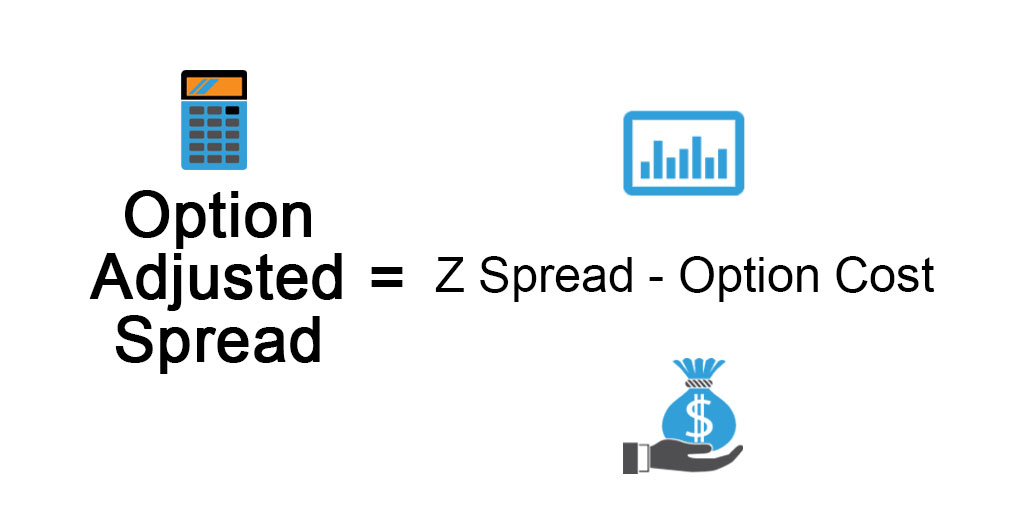

Option Adjusted Spread Advantages And Disadvantages

Benefits Of Buying A Home With A Va Mortgage Loan

The Math Behind The Mortgage Refinance Mortgage Mortgage Tips Buying First Home

Va Loan Basics Va Loan Rates Loan Rates Va Loan Mortgage Interest Rates

Tom Green Branch Manager Vp Of Lending Guranteed Rate Nmls 455500 Linkedin

Jamie Rogers Vp Of Mortgage Lending Guaranteed Rate Linkedin

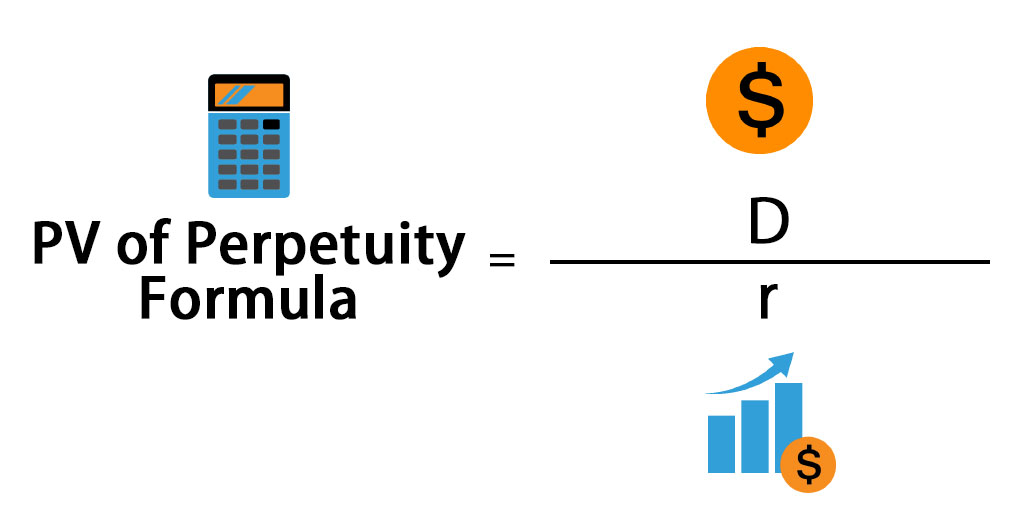

Perpetuity Formula Calculator With Excel Template

How Much Can You Afford For 1500 Month Mortgage Rates 30 Year Mortgage Current Mortgage Rates

Ex 99 2

5g6pscodr2eoxm

Sokhom Heng Senior Accounting Specialist Loan Servicing Academy Mortgage Corporation Linkedin

Pension Fund

Va Interest Rate Reduction Refinance Loans Loan Officer Marketing Flyers

The Riverdale Press 03 26 2020 By Richner Communications Inc Issuu

Ex 99 2